“Welcome to the Car-gang” The Business Model of Valuations

It was amusing to read a tweet by Anand Mahindra, the Chairman of the Mahindra group, welcoming Tesla to the automobile industry:

Want to learn more about traditional and emerging business model, value drivers and how to transform your business? Learn from our course on Business Model Transformation

Around the same time, we have seen several LinkedIn posts (many of them plagiarised!) analysing the upcoming public share issue (IPO) of Mamaearth, a “D2C” brand. There is consternation about the valuation multiples that are being sought, relative to its revenues and profits. What is common to both these stories?Welcome to the car-gang… pic.twitter.com/plGF9CoGQz

— anand mahindra (@anandmahindra) January 7, 2023

Business Model Categorisation

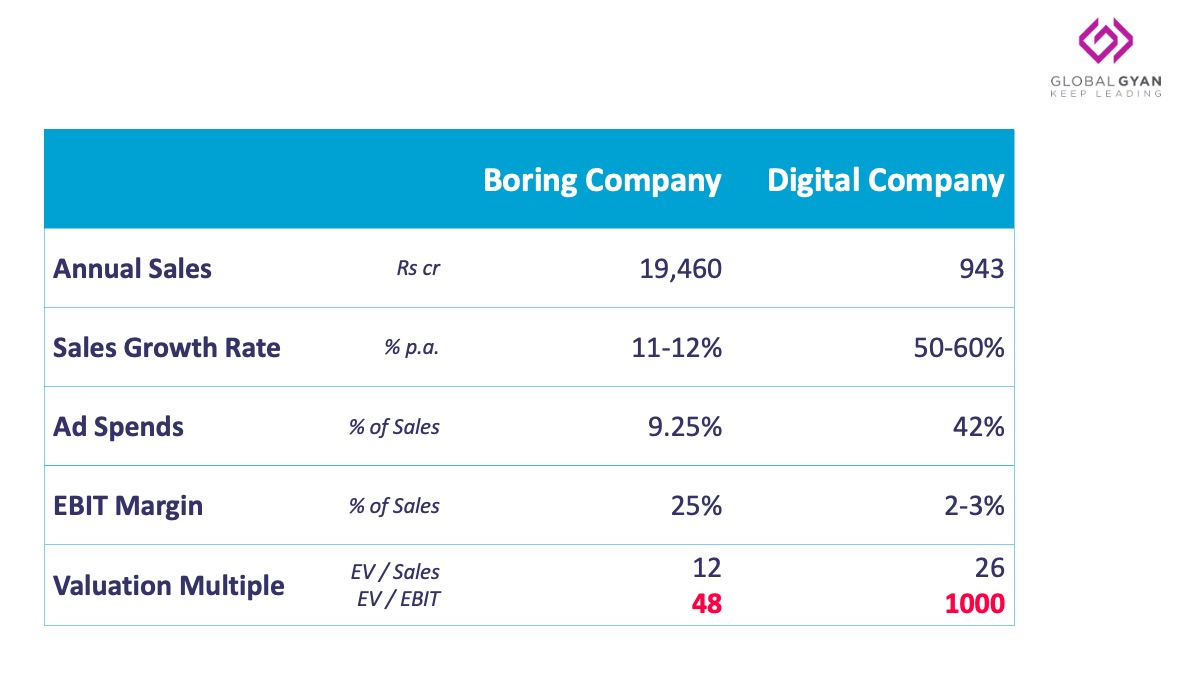

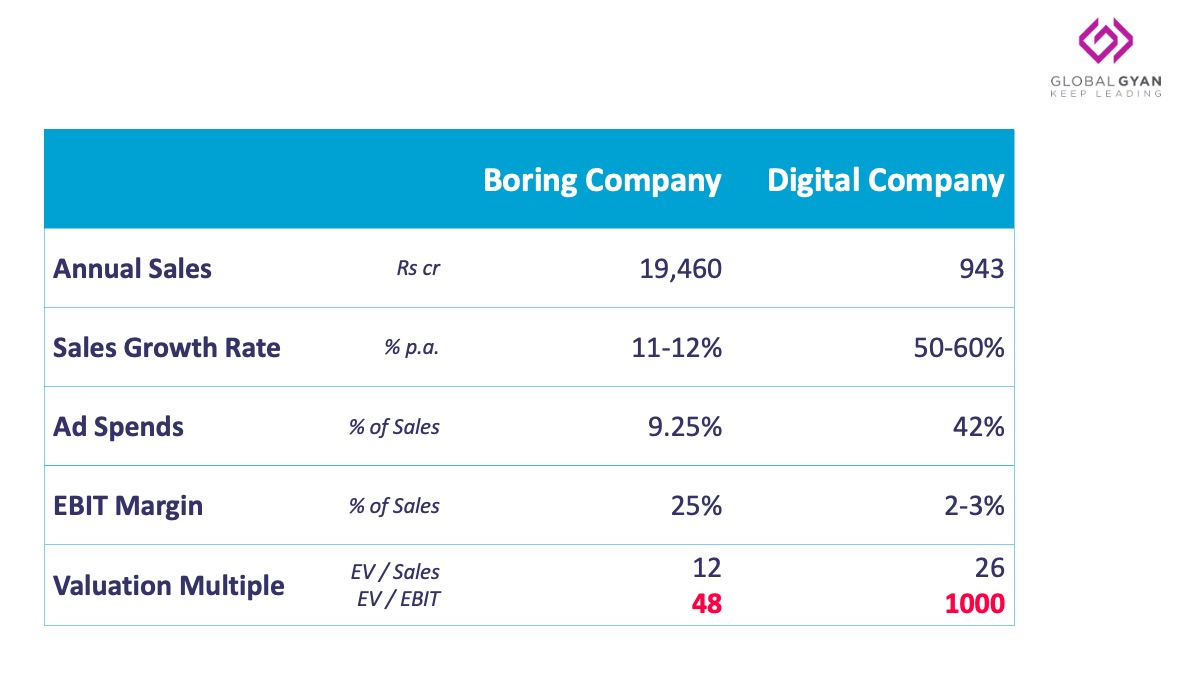

In this 2014 post for HBR.org, the authors discuss four different business models. It is evident that some models have much higher valuation multiples than the others. The variance in the valuation reason (not explicitly discussed in that article) can be attributed to three variables:- Growth Rates: This looks at how quickly can the business scale up; how large (or not) is the addressable market – are there any physical (time/distance/channel) constraints to reaching customers.

- Margins: What is the level of margin, and more importantly, does the business allow for economies of scale, i.e. new growth coming at much higher profitability than the previous.

- Capex Intensity: What is the level of capital expenditure required to grow sales, or can the business leverage investments already made or can it encourage others to invest on its behalf.

But…

What if the business is not really a D2C (only) company? Should it matter? Depends on what you care about. A lot of private investment has happened on the back of driving Growth (1) at a significant sacrifice of margins (2). Similarly, there is a liking for asset-lite models like platforms/aggregators that ride on others’ investments. If the primary metric that matters is valuation, then traditional businesses that are continuously optimising for all three are boring. Is it commendable that a new brand in the highly competitive beauty and personal care (BPC) segment has hit nearly Rs 1000 crores in FY22 and is growing its market share rapidly? Of course! Anyone should be proud of creating such a business. But, not if you are being driven by a different set of valuation metrics. The issue is in the drivers of growth and the underlying valuation approaches.The market leader in BPC spends 9-10% of its sales as advertising expenses for its 11% growth; the challenger is spending 40% for its >50% growth.The expectation from digital brands is that they are able to grow faster without all the expenses in marketing, sales and distribution that traditional companies incur. The growth strategy of Mamaearth seems to get it closer to the boring, offline distribution brands. Again, nothing wrong. It is probably a prudent approach.

It’s the Multiples!

The excitement of Digital and Platform models is that they continue rapid growth, at low cost and capex… thus, commanding high valuation multiples. If the assumptions change, the valuation will plummet. Which is what has happened to Tesla. Which is the risk that Mamaearth faces. Great businesses. Finding their right club…Want to learn more about traditional and emerging business model, value drivers and how to transform your business? Learn from our course on Business Model Transformation