Are you getting Porter’s Five Forces all wrong?

As a teacher of strategy, both to college students and to managers at all levels, I have sat through many project presentations. And when there’s a strategy presentation, can Porter’s Five Forces be far behind? Every other student or professional uses this popular framework. Most of the time, they get it wrong.

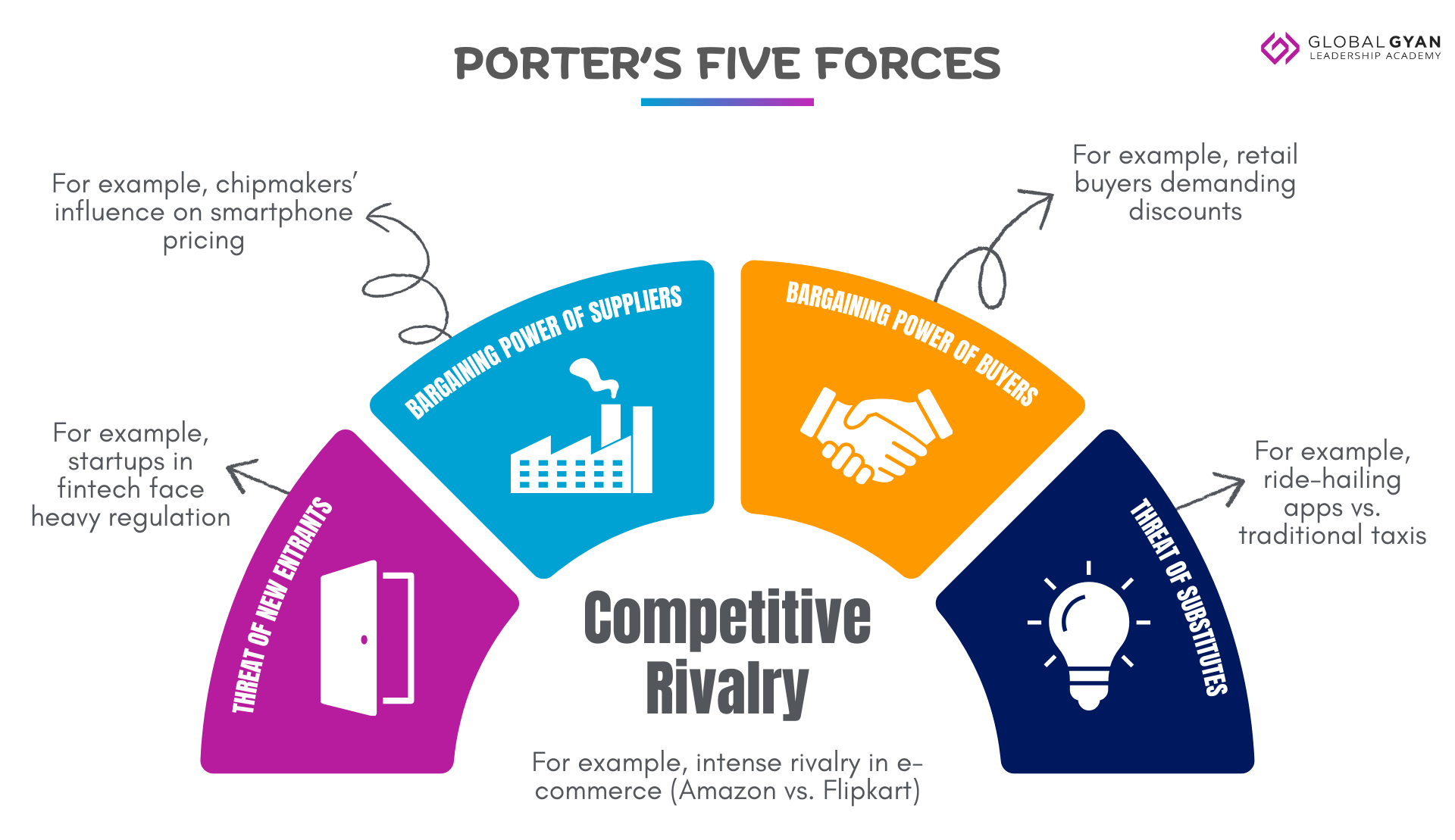

Before I get into the usage issues around this framework, let me quickly summarise it for those who may not be familiar.

First introduced in “How Competitive Forces Shape Strategy”, a 1979 HBR article, the Five Forces framework was Prof. Michael Porter’s response to the SWOT analysis, which he found to be lacking in rigour. By the way, SWOT is another framework that is found in practically every business presentation and again, used wrongly.

Porter talks about five forces that (negatively) impact the profitability (attractiveness) of any industry. You must read the HBR article for the details, but in summary, the five forces are:

Threat of New Entrants

Greater the ease of entry, lower the profitability of an industry. If new competitors can easily enter the market, they are likely to cause a downward pressure on price, and therefore, reduce margins. Also, just the fear (threat) of entry of new players causes incumbents to keep prices (and thus, margins) low to make it unattractive for those considering entry.

Entry barriers depend on various factors including regulations, upfront investments (more they are, tougher for new entrants) economies of scale, product differentiation, etc.

Bargaining Power of Buyers

Greater the bargaining power of buyers, lower the profitability of the industry. Customers use their bargaining power to negotiate lower prices for the products & services and thus, impact margins.

Buyer bargaining power arises from factors such as growth rate of demand (lower the growth, greater the power for customers), level of product differentiation, concentration of purchases (big buyers have more bargaining power), and so on.

Bargaining Power of Suppliers

Greater the bargaining power of suppliers, lower the profitability of the industry. Suppliers use their bargaining power to negotiate higher costs for their raw materials and other inputs, and thus, impact margins.

Supplier bargaining power arises from similar factors as the buyer side… our industry is a buyer for the supplier industry. So, the same factors work, but in reverse. For instance, if there are few suppliers or if they use proprietary technology, then they have greater bargaining power.

Threat of Substitutes

Not only must we look at new entrants who could create new competition, but also other products or services that could behave like competition due to their ability to substitute our industry. Greater the likelihood of substitution, lower the profitability for us.

While it was not highlighted by Porter then, technology plays an important role in creation of substitutes. On the other hand, changes in customer behaviour can also cause a product from another industry to be a reasonable alternative to the current one. Whatever may be the case, this is a force that is often overlooked, and has been responsible for many industries’ downfall.

Intensity of Rivalry

Finally, the central force of it all… more the intensity of rivalry between the existing players of an industry, lower the profitability or attractiveness. Since price tends to be the favourite and easiest tool to seek market share, competitors tend to bring prices down during periods of intense rivalry.

The factors impacting this intensity are the number of competitors, the level of differentiation, demand vs. supply, presence of exit barriers (if you cannot get out easily, you fight even more to survive) and so on.

What’s wrong with its usage?

There are two mistakes that most managers make when they present the Porter’s Five Forces analysis.

First, they just put up the 5 forces without any insight or analysis. Just listing a few bullet points and giving a Low-Medium-High rating for the forces does not convey anything useful to the audience. Why are you doing this analysis? How are you linking it to what follows? That’s rarely clear.

By the way, this is a problem for the use of most frameworks. It feels like you want to show off to the audience that you learnt something in your MBA or some training program, but haven’t really understood its purpose.

Second, this analysis is used for attractiveness measurement of an industry. By scoring each force (on a 3 or 5 point scale), managers try to provide a numerical measure of attractiveness. While that may be a starting point, the purpose of this framework is not to compare one industry versus another, in terms of attractiveness.

The real idea of this analysis to develop competitive strategy for a firm that is present in the industry or seeks to enter it. We analyse the attractiveness (or the lack thereof) of the industry to identify the chinks in the armour. What are the weaknesses that others have that we can exploit to build our advantage?

For instance, if bargaining power of suppliers is a major force that is causing industry profitability to be low, can we find new suppliers to break the stranglehold of the existing ones? Can we backward integrate or enter into a strategic sourcing arrangement so that we do not have as high costs as others do?

The idea is to find ideas or make choices that can improve our position vis-a-vis others. This is central to the development of strategy. Sometimes, our choices might cause everyone to (eventually) benefit and thus, the overall industry attractiveness could improve. Even that is an acceptable outcome, since the base level of profitability itself has been improved.

Next time, you feel like using Porter’s Five Forces framework (or in fact, any other), hopefully you will pause and reflect on how it connects with the rest of your presentation.