Why Enterprise Value Matters in Decision-Making?

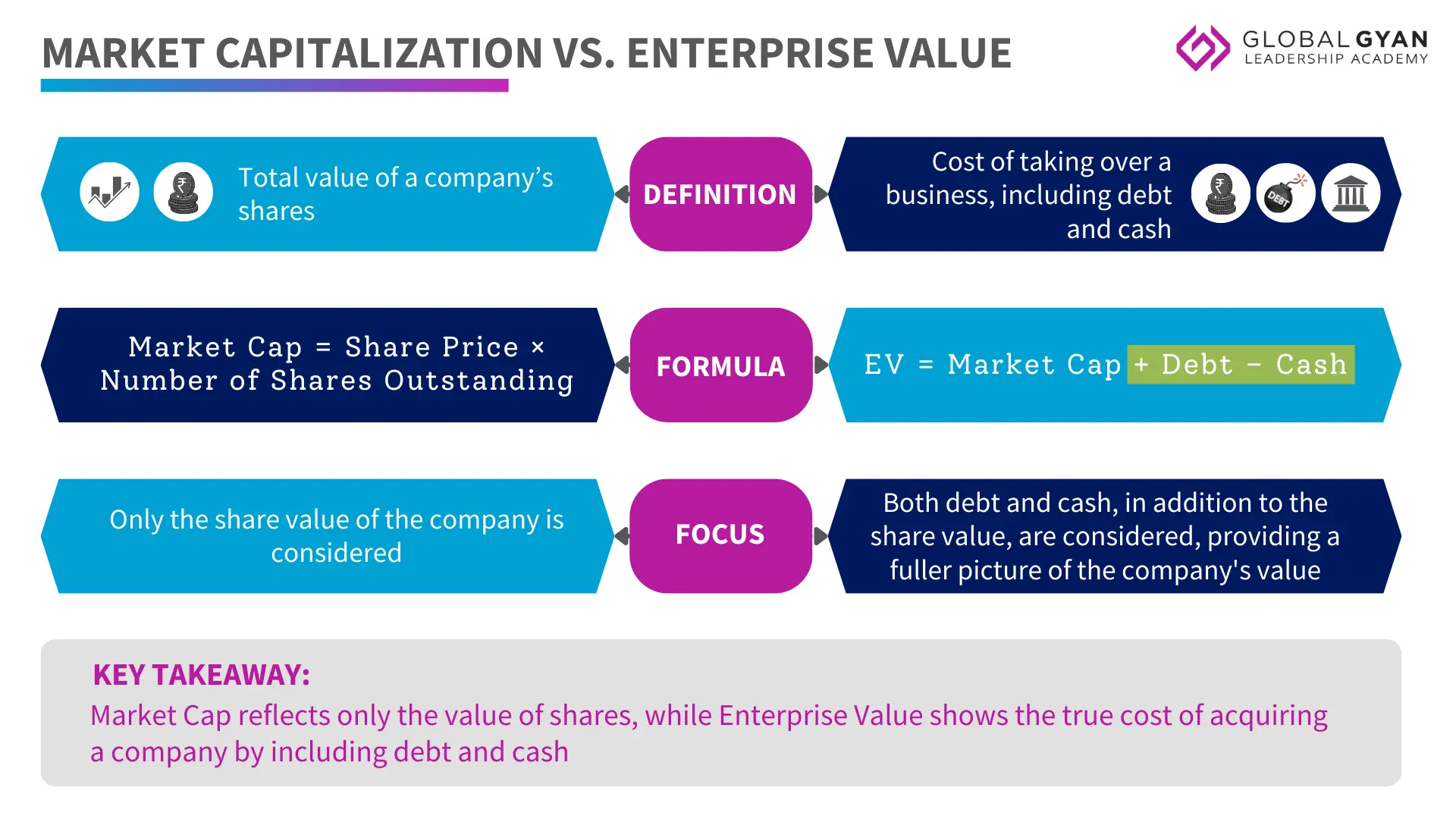

When we talk about the value of a company, most people immediately think of market capitalization (market cap). While this is an important metric, it doesn’t tell the whole story. That’s where enterprise value (EV) comes in. So, what exactly is it and why does it matter in the grand scheme of things?

Simply put, enterprise value refers to the total cost of taking over a business. Let’s say you’re considering acquiring a company. To do so, you wouldn’t just need to buy all its shares, but you’d also be responsible for its debts and could benefit from any cash the company holds. In essence, EV is a more comprehensive measure of what it would cost to completely take over a business, including settling its debts and gaining its assets in totality.

Components of Enterprise Value

- Market Capitalization (or Market Cap): This is the value of all the company’s outstanding shares. If a company has a market cap of ₹100 crore, that’s the total value of its shares based on current stock prices.

- Debt: When you acquire a company, you’re also taking on its debt. So, the cost to acquire it includes repaying that debt.

- Cash: After you take over a company, any cash reserves or bank balances the company has can be used to your benefit. Therefore, the company’s available cash reduces the net cost of acquisition.

All of these elements together give a more accurate picture of the enterprise value or what the company is really worth.

How is Enterprise Value Calculated?

The formula for calculating EV is fairly simple:

Enterprise Value (EV) = Market Cap + Debt – Cash

Let’s look at an example to understand this better.

Consider a tech company that’s in the process of being acquired. The company has:

- A market cap of ₹20 crore,

- Debt of ₹5 crore, and

- Cash reserves of ₹10 crore.

Using the EV formula:

Enterprise Value (EV) = 20 + 5 – 10

So, the enterprise value of the company is ₹15 crore. What this tells the acquirer is that, despite the company’s staggering ₹20 crore market cap, the actual cost of acquiring the business is slightly lesser, at ₹15 crore, after accounting for its debt and cash.

Why does Enterprise Value Matter?

For any manager involved in decision-making, especially with regards to mergers and acquisitions (M&A), understanding a company’s enterprise value is crucial. Here’s why:

A Holistic View of a Company’s Worth

While market capitalization provides a basic idea of a company’s value, it doesn’t take into account factors like debt and cash. For example, two companies might have the same market cap, but if one has a lot of debt and the other has none, the true cost of acquiring them will be very different. EV provides a more complete picture by including these key financial elements.

Debt Matters

If a company has significant debt, its EV will be much higher than its market cap. This could make it a less attractive acquisition target, as the buyer would have to pay off the debt in addition to purchasing the shares. On the flip side, a company with little debt and lots of cash would have a lower EV, making it more appealing for potential buyers.

Cash Can Be a Game Changer

A company with large cash reserves can significantly reduce its EV, making it a more attractive acquisition target. In fact, in some cases, the EV can even turn negative if the company has more cash than debt and market cap combined. This would mean that the acquirer essentially gets the business for free and even gains cash in the process.

Factors that Influence Enterprise Value

While the formula for calculating EV is straightforward, several factors can influence a company’s market cap, debt, and cash reserves, making EV fluctuate over time:

Market Dynamics

Market cap can vary due to several factors, such as global market trends, sector-specific conditions, or cyclical economic changes. For example, during a market boom, a company’s stock price (and hence its market cap) might be inflated, giving the illusion of a higher value. Conversely, during a downturn, market cap might shrink, even if the company’s underlying fundamentals remain strong.

Debt Levels

Companies take on debt for various reasons, such as funding expansion, new projects, or even acquisitions. Debt-heavy companies will have higher EVs, which could make them less attractive acquisition targets. However, in some cases, if the company is using the debt to generate higher returns, this might be seen as a positive by potential buyers.

Cash Reserves

Companies with large cash reserves are often seen as financially healthy. This cash can be used to pay off debt or fund new ventures, making such companies more appealing. A high cash balance lowers the EV and, in some cases, can even make the acquisition look like a bargain.

Enterprise Value vs. Market Cap: What’s the Difference?

The Limitations of Enterprise Value

While enterprise value is useful for evaluating a company’s worth, it’s not foolproof. Several limitations need to be considered:

Market Cap Volatility

Since EV relies on market cap as a key component, it can be impacted by short-term market movements. For instance, if a company’s stock price suddenly drops due to external factors (e.g., global economic downturns or political events), its market cap and EV might decrease even though its underlying business remains strong.

Cyclical Businesses

Some companies operate in industries that are highly cyclical, meaning their value can fluctuate based on economic conditions. For example, a manufacturing company might have high EV during a booming economy, but its value could decrease significantly during a recession, even if its fundamentals haven’t changed.

For more such in-depth insights into financial concepts, enrol in our finance courses today!

Responses