Is a Debt-free Company Better than one with Debt?

I get asked this question about the attractiveness of a debt-free company very often during my strategy or finance sessions. In this article, I try to answer the question in a practical way that doesn’t require you to look up a dictionary or a finance text book. Also, this is a question that we can extend to our personal financial decisions.

One concept of finance we will use here is that any investor expects a certain rate of return; this is called the opportunity cost of money or the cost of capital. This expected return is linked to the level of risk involved in the investment. More the risk, higher the expected return.

A company has two primary sources of raising money:

- Equity shareholders who invest to own a part of the company (Equity)

- Financial institutions or banks who lend money in the form of a loan (Debt)

An Equity investment, by design, carries higher risk – there is no guarantee of success and any returns. Therefore, an equity investor usually has a higher expectation of return.

On the other hand, Debt has lower risk because it is normally covered by conditions and constraints, and backed by some guarantees or assets. Also, the cost of debt, or interest, is treated as a business expense and therefore, reduces the tax burden of the company. Therefore, for any company, the cost of Debt is lower than the cost of Equity.

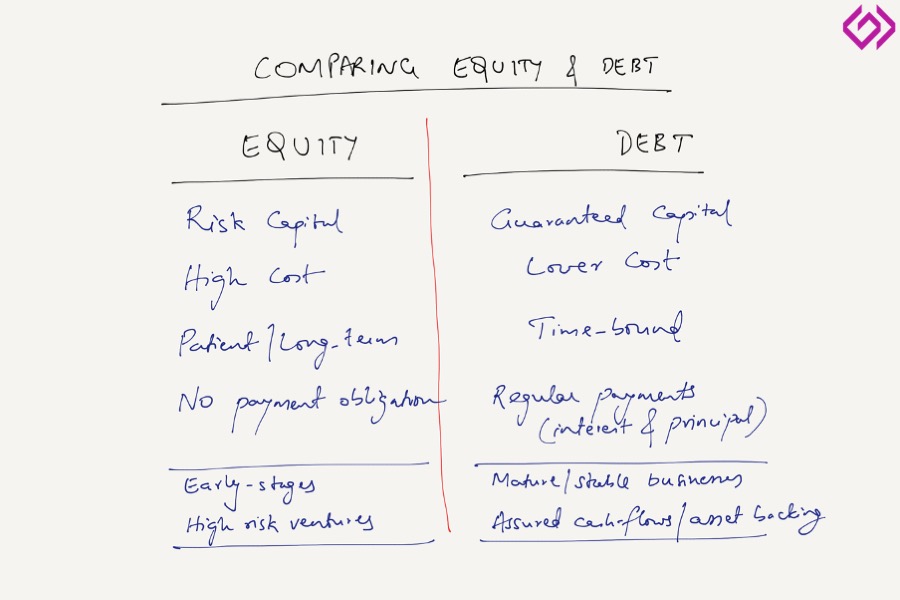

Comparing Debt and Equity

Equity is risk capital, to support long-term business growth. Equity investors don’t have any expectations of immediate returns nor is there any obligation to pay them annually. The company pays equity shareholders only when it has achieved a capacity to do so, if at all. At the start of a company, equity is essential till the viability the business is proved.

Debt can be either short-term or long-term, that is often available only when the business has achieved a certain degree of stability. The cost of debt, i.e. interest is a clearly known amount and has to be paid at agreed intervals. Inability to pay the interest can cause penalties or the loan to be called back. Also, the loan itself has to be repaid over time or at the end of a pre-determined period.

Now let us look at three scenarios.

1. Company in Startup Stage

In its early years, a business is a high-risk venture. Revenues are yet to grow, therefore, the company is loss-making. Whether the business will achieve its plans are still unproven.

In this stage, the only logical source of capital is Equity. The company needs investors who believe in its potential and are willing to take the risk. Further, since there is no obligation of repayment, the entrepreneurs/promoters are protected, in case of business failure.

In this stage, almost every company is a debt-free company because no bank is likely to lend to it.

2. Company in Growth Stage

Consider a company that has proven itself in the market and is growing rapidly. Its current business is profitable but it needs capital to grow. Maybe it wants to expand its production capacity or enter new markets or build new technology platforms.

Should it raise Equity or Debt?

Ideally, debt would be preferable. Adding debt to the capital mix would reduce the weighted average cost of capital, and therefore, the overall returns that the business must generate. Or, conversely, the equity shareholders who bore the upfront risk will now get better returns on their investment.

Mixing a fair amount of debt with equity improves the returns for equity shareholders.

Return on Equity increases with the addition of Debt to Capital Mix

Applying it to the Personal Context

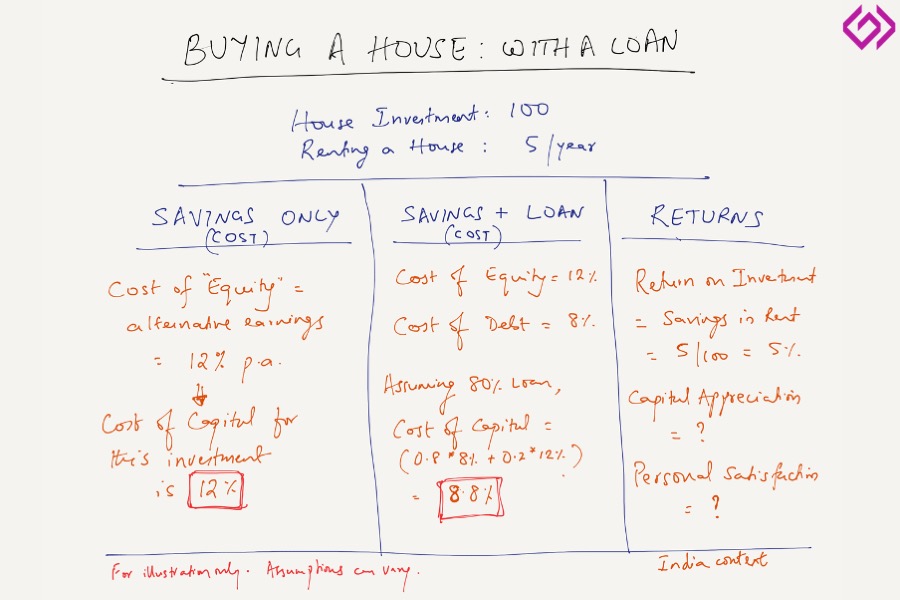

The same rule applies to us as individuals. Let’s see… you want to buy a house costing 100 and you have that amount available in your savings. You could invest the entire 100 as your equity contribution to buy the house.

But what you are ignoring is the opportunity cost of your equity investment. Could you have earned more by investing some or all of that 100 in any other opportunity? Maybe your safe mutual fund portfolio has been generating 12% post-tax returns. In this case, your equity-only capital has a cost of 12%.

On the other hand, if you had taken a loan for 50% of the house purchase, at 8% interest. Now, your cost of capital has dropped to 10%, which is a weighted average of 8% and 12%. It is as if you are earning 2% more by introducing debt into your capital mix.

Of course, a larger question might come up about the investment decision itself. If the return on investment, i.e. savings in rent paid, is only 5%, why would you invest at 12% or even 10%? You would have to believe that your capital appreciation would be at least 5% per annum and you could attribute some “return” to the satisfaction of owning a house.

Housing Loan reduces Cost of Capital; is Buying still Worth it?

(Please don’t treat this as personal finance advice. For many individuals, not having the overhang or burden of debt provides comfort and is handy during uncertainty / bad days. At the same time, if you know how to manage your finances well, you can optimise your capital for the best returns.)

3. Highly Profitable Company

We can see this situation in IT services companies or other high-margin businesses. They make so much profit every year that they can meet all their investment requirements through their own cash. They are debt-free. In fact, they have huge loads of cash sitting in their banks.

What should such a company do?

Money sitting in the bank is not really earning much, maybe a low single digit number. That money belongs to shareholders whose expectations (cost of equity) are much higher. In a way, this is value destruction.

Shareholders of such companies often ask for the money to be returned to them, so that they can invest in better opportunities. Or the company has to convince them that it has specific plans to make investments in growth.

A famous example of this tussle was at Apple and in 2013, it agreed to repay $100 Billion to its shareholders within 2 years. Since 2013, Apple has borrowed money (introduced debt to its capital) and repaid $385 Billion to its shareholders.

To sum up, debt is not always bad, and not every debt-free company is a great one. Depending on the business life stage and financial situation, debt can be an important mechanism to invest in growth and simultaneously improve returns to shareholders.