3 Financial Concepts of Decision Making for Everyone

Business decisions, particularly those involving investments, require managers to build financial models and evaluate the attractiveness of the investment. As we go about this process, there are three financial concepts of decision making that are crucial.

The basis of any investment is that we spend money now (outflow) and get money back in future (inflows). A prudent investment decision would ensure that the inflows are greater than the outflow(s).

However, we cannot just take the numerical sum of future cash flows and compare it with the current outflow. This is like adding apples and mangoes and strawberries, and comparing them with oranges. That’s because of the Time Value of Money. Since (most of the time, at least) money can earn some return when utilized appropriately (say in a fixed deposit @ 10% p.a. interest), Rs 100 today would result in Rs 110 after a year. Conversely, Rs 110 next year is worth only Rs 100 today.

Money in Future is worth Less in the Present. Don’t compare their absolute values.

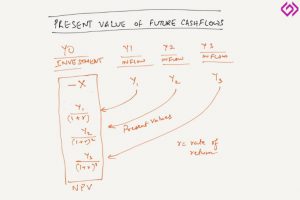

So, when we forecast cash flows of future years, and wish to compare them with current investments, we need to make all the numbers equivalent in terms of time. The simplest method is to bring them to the present time (because the investment decision is being made now). We calculate the “present value of future cash flows“.

Here we use the formula for compound interest. We know the future value, A; we know the year, n in which that amount has been generated; and the annual interest rate, r. Now calculate, P (the principal, or present value).

A = P (1+r)^n

P = A / (1+r)^n

Do this for each future year’s cash flows. Now, since they are all equivalent, in the present time, we can add them up. We also add the investment or outflow being made in the current year.

The net value of all cash flows, calculated in the present time, is called the Net Present Value (NPV) of an investment.

(Fortunately, we don’t have to do all this difficult work. Microsoft Excel makes it easy for us to calculate this.)

Obviously, if the NPV is > 0, then the investment is worth making. If it is < 0, then the investment loses value. If it is 0, we are financially indifferent to it, i.e. we could invest our money in something else or check if there is any other reason to make the investment (strategic or emotional) that swings the decision. A key input into this calculation is “r”, the rate of return that one uses to calculate present values.

Remember, we can do many things with our money. From something as simple and low-risk as leaving it in the current account of a bank to making a term deposit to investing in mutual funds to buying equity shares of a company. Each option carries different levels of risk, and therefore, our expectations of returns also increase to factor in the risk probability of losing the money.

At a certain level of risk, investors have a certain expectation of returns. This is partly determined by what other investment opportunity is available with a similar risk, and what is the return that one gets from the alternatives.

Since we have an opportunity to invest our capital in various options, and our desired returns are linked to alternative returns available, the expected return on investment is referred as the Opportunity Cost of Capital.

Depending on the nature of capital, this is called Cost of Equity or Cost of Debt, and since most businesses have a mix of both, together they become the Weighted Average Cost of Capital (WACC, r).

Any investment should deliver a return at least equal to, preferably, greater than WACC. Do remember these three financial concepts of decision making, whether you are investing for your business or for your personal finance.