3 Steps to Get Ready to Quit My Job

It is every employee’s fantasy: quit my job. Be on my own. No boss to dictate my life.

Many years ago, I did exactly that and almost all my colleagues told me then they would like to follow suit. Not one of them did it. Yet, this is a request I get all the time: can you help me, how can I quit my job?

For now, let us put aside the question if you should quit the job at all, and if it worth it. I want to share a few thoughts on building readiness for it. This is an updated version of a piece that I wrote a few weeks after I had quit.

In my experience, there are three major steps.

1. Financial Planning

One of the certainties of having a job is the pay-check at the end of each month. Over time, as the salary increases, your monthly earning is easily much more than what you need to spend. But you stop caring. Of course, many of us plan for the future and make investments / retiral funds, etc. However, the reality is that you don’t know how much money you need. You earn X and as long as you are spending / investing less than X, you are OK. (By the way, when I say “you”, I am referring to all the earning members of your family; depending on the composition of the earning, some of the below may not be relevant to you.)

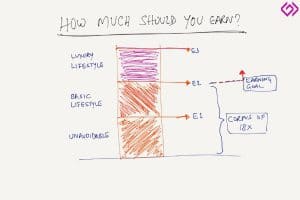

The day you become self-employed, the X vanishes. Now you have an income stream that could vary considerably month to month. The approach now has to be, what is the Y that I must earn every month in order to live a decent life. For that, you have to first define what “decent life” entails. would suggest this framework derived from Tim Ferriss’ 4-Hour Work Week

What are your unavoidable expenses, E1 (e.g. society maintenance, electricity, school fees, groceries, phone bills, insurance premiums, etc.)?

What are your basic lifestyle expenses, E2 (e.g. eating out / movies once in a while, fuel and driver expenses, new handset once in x months, clothes & accessory shopping, replacement of consumer durables, repairs & maintenance, etc.)?

Finally, what are your luxury lifestyle expenses, E3 (e.g. family vacations, new gadgets, new jewelry, saving more for future, etc.)?

Believe me, getting to an estimate of these numbers is not easy since most people don’t track their expenses at this level. Once you have an estimate of E1, E2 & E3 (all converted to a monthly equivalent), you can decide where to draw the base-line. I would believe that E1+E2 (net of what other members of your family earn) would be the minimum line and E1+E2+E3 is the earning goal.

As I said earlier, some months, particularly in the initial months may not get you E1+E2, maybe not even E1. So you have to be prepared for it, with liquid funds available to take care of the short-fall. Also, in order to ensure that E1 is not a humongous scary figure, the following assets should have been already paid for: the house you live in and the car that you drive. With the big ticket items out of the way, you should have liquid / near-liquid funds equivalent to at least 18 months of E1+E2. That will give you the freedom to experiment with your new career/life without worrying about basic necessities. The 18 month funda is simple… 12 months to experiment without any tension and 6 months to find a new job, if you eventually decide to give up.

The biggest learning of this exercise is that you will now be able to earn what you need rather than spend what you earn.

2. Make a Positive Change

Self-employment is not a solution for a job gone wrong. Don’t take a negative decision to quit your job out of frustration and think that being self-employed will give you joy. Not only will your monthly pay-check vanish, but also many other things that you take for granted will go with your job.

The biggest issue will be to answer the question, “What do you do?” Try explaining to your grandmother or the nosy neighbor why you don’t go to office any longer. You were used to people listening to you when you spoke as the ‘so&so’ of this big company; now, you represent yourself and it is a very different thing.

Being self-employed will also mean a whole bunch of new administrative things that you never worried about earlier. Get yourself registered for GST and professional tax; raise invoices; collect your dues; pay GST & deduct TDS and advance tax quarterly; track all your business expenses and create your P&L… the list goes on!

The only reason to still go through with it is because you care about what you want to do. The passion to do something different should drive you to make the change and will help you through the uncertainties and challenges of carrying it on. So, make a positive change.

Another thing: if you have to ever give up your new endeavor and go back to your job, it would help that you didn’t hate it in the first place!

3. Test Market your Passion

It is one thing to believe that you like something and another to live your life doing it. One way to know for sure is to of course, do it. But that need not be the only way. Why not test it out, if possible? How would it feel when you actually pursue the new career idea? And more importantly, would others (say, your prospective customers) accept you in that role?

In my case, I got several opportunities to test out my interest in teaching, both within my corporate environment as well as outside, in the academic world. Since it was “teaching” (seen as a ‘noble’ activity), I was able to do it while keeping my day job but it may not be possible for you to moonlight as a consultant.

An alternative test would be to write out your “pitch” – why should anyone engage you? Are you able to create enough value to charge the price that your earning goals demand? Writing out your value prop and perhaps, your business plan, will help you clarify your thoughts and build confidence about what you are about to embark on. This stage is extremely crucial and requires a systematic approach.

Those are my three preparatory steps towards making the transition from corporate to self employment. The chasm from ‘I want to quit my job’ to actually doing it is huge and deters most employees. Whether you do it voluntarily or are forced to make the jump, being prepared is wise.